The Greatest Guide To Estate Planning Attorney

The Greatest Guide To Estate Planning Attorney

Blog Article

Examine This Report on Estate Planning Attorney

Table of ContentsNot known Facts About Estate Planning AttorneyGetting My Estate Planning Attorney To WorkEstate Planning Attorney for DummiesHow Estate Planning Attorney can Save You Time, Stress, and Money.

Estate preparation is an activity strategy you can make use of to establish what takes place to your possessions and obligations while you live and after you pass away. A will, on the various other hand, is a lawful record that describes how assets are distributed, who takes care of youngsters and animals, and any type of other wishes after you die.

Cases that are rejected by the executor can be taken to court where a probate court will certainly have the last say as to whether or not the case is legitimate.

Estate Planning Attorney Can Be Fun For Everyone

After the inventory of the estate has been taken, the worth of properties computed, and tax obligations and financial obligation settled, the executor will certainly after that seek authorization from the court to distribute whatever is left of the estate to the recipients. Any type of estate taxes that are pending will come due within 9 months of the date of death.

Each individual areas their possessions in the depend on and names somebody other than their partner as the recipient., to sustain grandchildrens' education and learning.

Estate Planning Attorney Can Be Fun For Anyone

Estate organizers can work with the contributor in order to lower taxable revenue as a result of those contributions or create methods that take full advantage of the effect of those donations. This is an additional technique that can be made use of to restrict death tax obligations. It involves a specific securing the present worth, and thus tax obligation Resources obligation, of their home, while connecting the value of future growth of that resources to another person. This method includes cold the value of a possession at its worth on the day of transfer. Accordingly, the amount of possible funding gain at fatality is additionally frozen, allowing the estate coordinator to approximate their possible tax obligation obligation upon death and better plan for the repayment of revenue taxes.

If adequate insurance policy proceeds are available and the policies are appropriately structured, any kind of income tax obligation on the deemed dispositions of assets complying with the fatality of a person here can be paid without turning to the sale of properties. Proceeds from life insurance coverage that are gotten by the recipients upon the death of the insured are normally revenue tax-free.

Other charges connected with estate planning include the preparation of a will, which can be as low as a few hundred dollars if you use one of the ideal online will certainly manufacturers. There are specific papers you'll need as part of the estate preparation procedure - Estate Planning Attorney. A few of the most typical ones include wills, powers of lawyer (POAs), guardianship classifications, and living wills.

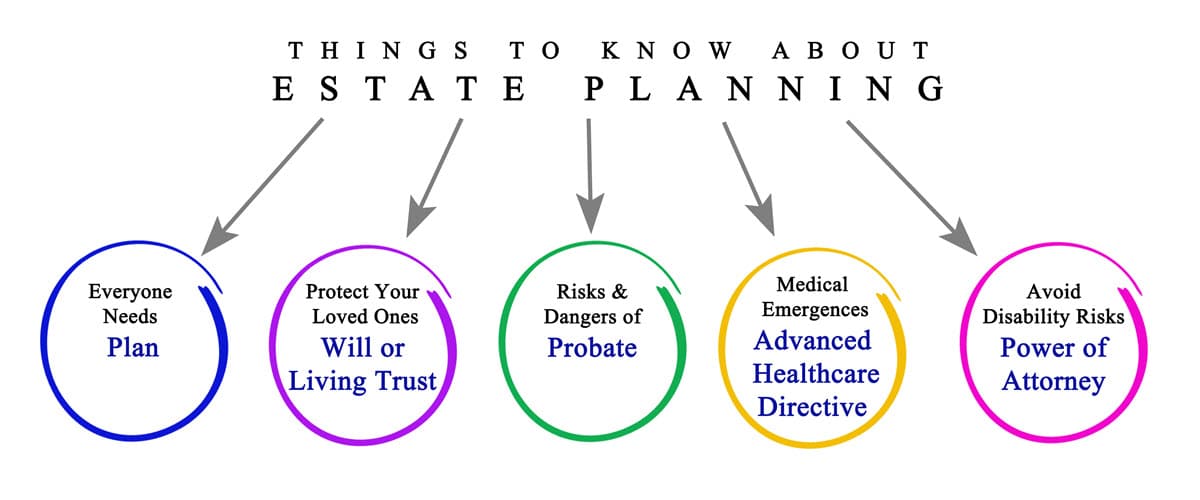

There is a misconception that estate planning is only for high-net-worth individuals. Yet that's not real. Estate preparation is a device that everyone can use. Estate intending makes it less complicated for people to establish their desires this before and after they pass away. As opposed to what the majority of people think, it expands past what to do with possessions and liabilities.

About Estate Planning Attorney

You need to start intending for your estate as soon as you have any kind of measurable possession base. It's a recurring process: as life advances, your estate strategy should change to match your situations, in accordance with your new goals. And maintain it. Not doing your estate planning can create undue monetary worries to loved ones.

Estate preparation is usually taken a tool for the affluent. Yet that isn't the case. It can be a beneficial method for you to manage your properties and liabilities before and after you die. Estate planning is additionally an excellent method for you to outline strategies for the treatment of your small youngsters and pet dogs and to detail your dreams for your funeral service and favored charities.

Applications should be. Qualified candidates that pass the exam will be formally licensed in August. If you're qualified to rest for the exam from a previous application, you may submit the brief application. According to the regulations, no certification shall last for a duration longer than five years. Figure out when your recertification application schedules.

Report this page